-

Numero contenuti pubblicati

13393 -

Iscritto il

-

Ultima visita

-

Giorni Massima Popolarità

61

4200blu è il vincitore del giorno 19 Giugno

I contenuti pubblicati da 4200blu, sono stati i più apprezzati della giornata! Complimenti e grazie per la partecipazione!

Informazioni Profilo

-

Marca e Modello Auto

Lancia e altri

-

Città

a casa

Visite recenti

47167 visite nel profilo

La popolarità di 4200blu

HALL OF FAME (8/8)

15,9k

Reputazione Forum

-

- 121 risposte

-

- 3

-

-

-

- audi ufficiale

- a5 2024

- (e 15 altri in più)

-

- 188 risposte

-

- 121 risposte

-

- 3

-

-

-

- audi ufficiale

- a5 2024

- (e 15 altri in più)

-

Produzione fine maggio 2000, una delle poche con gli airbag laterali che hanno introdotto ad fine aprile, stranamente 3 mesi prima della EOP. Quasi una delle ultime a richiesta, dopo hanno solo prodotto la serie limitata di addio (almeno per le 20VT).

-

- 124 risposte

-

- 13

-

-

-

-

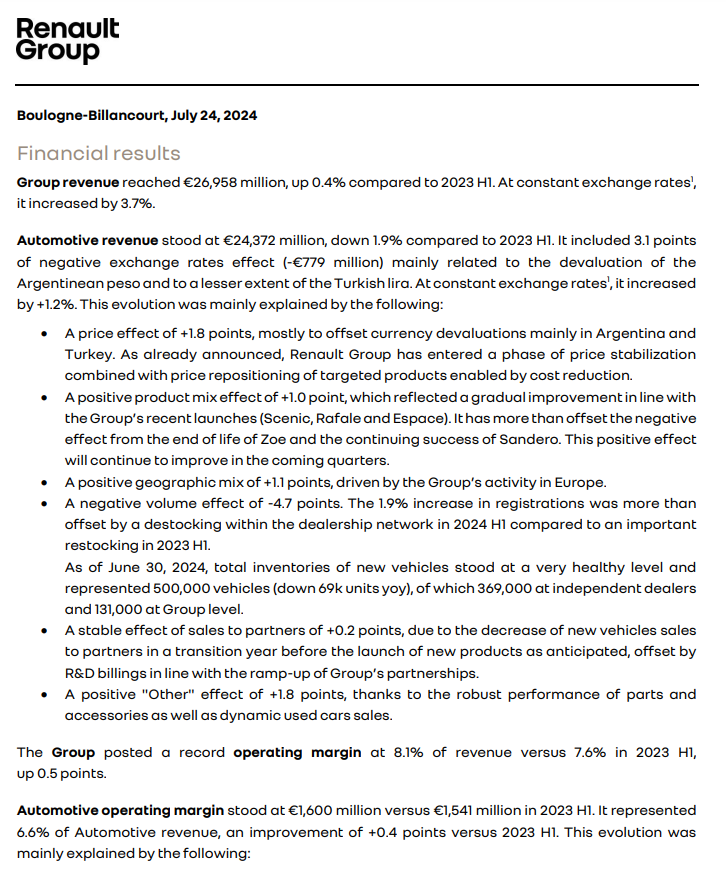

Si certo, perche anche per le DS possono usare il motore unitario a 3cil, per Maserati questa sarebbe difficile quindi DS sta molto meglio insieme con il resto della baracca rispetto Maserati

-

Hyundai to expand hybrid lineup after posting record profit Hyundai profit was also helped by favorable exchange rates and demand for higher-end vehicles. SEOUL -- Hyundai reported record quarterly profit and revenue on strong sales of high-margin cars and said it would expand hybrid line ups to brace for possible changes in U.S. electric vehicle policies following the election. Hyundai, which together with its affiliate Kia is the world's No. 3 automaker by sales, reported a net profit of 4 trillion won ($2.89 billion) for the April-June period, up from 3.2 trillion won in profit a year earlier. The net profit was its highest quarterly since the previous record high set in the second quarter of 2022. Favorable exchange rates and strong sales of high-margin SUVs boosted earnings. Hyundai warned of an uncertain outlook due to intensifying price competition as inflation and high interest rates squeeze consumers. "As consumer demand for autos is weakening, we expect there will be more competition and the amount of incentives is also likely to increase ... creating a tougher business outlook," the automaker said in a July 25 earnings release. Hyundai outperformed some of its rivals including EV leader Tesla and other legacy auto makers such as Ford, by boosting sales of premium SUV models and hybrid vehicles in the U.S., a move that also helped it offset a prolonged sales weakness in the domestic market. Domestic vehicle sales in South Korea, Hyundai's second-biggest market, slumped 10 percent the second quarter, extending from a 16 percent drop in the previous quarter, as consumers continue to grapple with surging inflation and a weak economy. Its vehicle sales in the U.S. edged up 2.2 percent in the quarter. High-margin SUV sales accounted for about 80 percent of the total while hybrid vehicle sales jumped 42 percent from the same period a year ago, Hyundai said. Analysts also said the favorable exchange rate in the quarter had helped Hyundai's profit growth. The won slumped 4.3 percent against the dollar in the quarter from a year earlier, boosting Hyundai's repatriated overseas sales and profit. U.S. uncertainty Hyundai said it would expand hybrid lineups as demand for EVs eases globally and uncertainty mounts over U.S. EV policies. Former President Donald Trump, the Republican candidate, is critical of the EV policies of Democrat President Joe Biden and has said he will "end the electric vehicle mandate" if he wins. "Even if Trump wins the election, we don't expect the Inflation Reduction Act (IRA) to be scrapped," Hyundai Chief Financial Officer Lee Seung Jo told analysts on an earnings call, referring to Biden's signature clean energy policy. Lee said the company continues to monitor possibilities and plans to increase hybrid lineups "to prepare for possible shrinking of the IRA package." Hyundai said profitability of its hybrid models was similar to that of gasoline cars, highlighting the segment's growing contribution to the bottom line, as sales of pure EVs dropped almost by a quarter. (ANE)

-

- 1115 risposte

-

- italdesign

- jetta

-

(e 15 altri in più)

Taggato come:

-

Stellantis is ready to drop money-losing brands, CEO Tavares says Margins declined significantly in North America, Stellantis's key region for profits. Stellantis signaled that it is prepared to drop underperforming brands after a steep slump in first-half earnings. The automaker's net income fell 48 percent in the first six months to €5.6 billion ($6.1 billion). Its operating margin shrunk to just below 10 percent, slipping below the double-digit margin it aims to achieve for the full year. CEO Carlos Tavares said Stellantis will not hesitate to ax loss-making brands. "If they don't make money, we will shut them down. We cannot afford to have brands that do not make money," Tavares told reporters on a July 25 earnings call. Tavares told Bloomberg Television that all of the group's brands are important assets and profitable, but there is "absolutely no taboo" if their performance were to deteriorate. The brands "are here to be leveraged," he said. "If they are not able to monetize the value that they represent, then decisions will come." The warning for loss-making brands is a turnaround for Tavares, who has maintained since Stellantis was created in 2021 from the merger of Fiat Chrysler and Peugeot-owner PSA Group that all of its 14 brands including Maserati, Fiat, Peugeot and Jeep have a future. Stellantis does not release figures for individual brands, except for Maserati which reported an €82 million adjusted operating loss in the first half. Some analysts say Maserati could possibly be a target for a sale by Stellantis, while other brands such as Lancia or DS might be at risk of being scrapped given their marginal contribution to the group's overall sales. North America problems Stellantis also said it will take steps to address problems in its North American market, where the company has seen high inventory levels, a string of executive departures and quality issues weigh on profit. First-half margins declined most significantly in North America, a key region for profits, after shipments fell 18 percent amid an unfavorable model lineup and pressure on prices. Chief Financial Officer Natalie Knight said Stellantis would reduce production in North America this quarter, as well as prices. "That's one of the things that is important for us, to calibrate how the supply and demand meet," she said. Stellantis also plans to further lower labor costs and expects a 25 percent reduction in logistics expenses in the second part of the year. Knight also suggested the company may reconsider what would be "the best home" for Maserati, whose shipments plummeted by more than half to 6,500 units in the first six months. Tavares said he would be working through the summer with his U.S. team on how to improve performance and cut inventory. "We consider that the job is done in Europe," he said. "The job is not done in the U.S. and we are now going to take care of that work." The high-margin RAM pickups and Jeeps that Stellantis sells to U.S. consumers have driven its profits, but the company's weak margin "raises questions over Stellantis' cost efficiency reputation," Bernstein analysts wrote in a client note. Betting on new models New model launches -- a total of 20 planned for this year -- will help profitability in the second half, Knight said. Stellantis will be reintroducing some models it had pulled from the U.S., including the Dodge Charger, she said. The automaker's launches this year include a refreshed Ram 1500 pickup in the U.S., a renewed Pro One van lineup in Europe from Peugeot, Citroen, Fiat and Opel/Vauxhall and the third-generation Peugeot 3008 compact SUV, the first Stellantis car on the STLA Medium platform that can be used for battery-electric and combustion engines variants. Stellantis will also begin sales of EVs from its Chinese partner Leapmotor in 9 European markets, including Germany, the U.K. and Italy, in September. The first shipment of Leapmotor EVs for Europe is en route from China. Stellantis now considers Leapmotor as its 15th brand, after it bought a 21 percent stake in the Chinese company for €1.5 billion in October 2023. (ANE)

-

Stellantis to reduce output, cut prices after earnings plunge on weak U.S. results Margins declined significantly in North America, Stellantis's key region for profits. Stellantis said it will take steps to address problems in its North American market and elsewhere, including cutting output and prices, after reporting worse-than-expected first-half results. Net income fell 48 percent in the first six months to €5.6 billion ($6.1 billion), the automaker said. Its operating margin on adjusted EBIT shrunk to just below 10 percent, slipping below the double-digit margin it aims to achieve for the full year. "The company's performance in the first half of 2024 fell short of our expectations," CEO Carlos Tavares said in a statement on July 25. Margins declined most significantly in North America, Stellantis's key region for profits, after shipments declined 18 percent amid an unfavorable model lineup and pressure on prices, the company said. Chief Financial Officer Natalie Knight said Stellantis is taking "decisive actions to address operational challenges." Measures include inventory reduction, especially in North America. "(That) is the market that needs the most work and where we are most concentrated when we look at the second half," Knight said. "There are operational issues we have had in North America where I think we could have performed stronger." Knight said Stellantis would reduce production in North America this quarter, as well as prices. "That's one of the things that is important for us, to calibrate how the supply and demand meet," she said. Stellantis also plans to further lower labor costs and expects a 25 percent reduction in logistics expenses in the second part of the year. Knight suggested the company may reconsider what would be "the best home" for Maserati, even though for now the group remains focused on driving improvements at the Italian luxury brand, whose shipments plummeted by more than half to 6,500 units in the first six months. Stellantis is under increasing pressure as it deals with high inventory levels and a string of executive departures in the U.S. The company has already extensively cut costs, with €500 million more in savings planned for the second half. Some analysts have started flagging the limits of Tavares' strategy on costs. He has also faced pushback from shareholders and advisory firms over his $39 million pay package for last year, a 60 percent increase from 2022 levels. Analysts at Citi said in a note they expect Stellantis's problems to continue. "We see no real improvement until and unless Stellantis removes the overhang from inventories – which itself would put pressure on full-year ...margins," they wrote. Betting on new models New model launches -- a total of 20 planned for this year -- will help profitability in the second half, Knight said. Stellantis will be reintroducing some models it had pulled from the U.S., including the Dodge Charger, she said. The automaker's launches this year include a refreshed Ram 1500 pickup in the U.S., a renewed Pro One van lineup in Europe from Peugeot, Citroen, Fiat and Opel/Vauxhall and the third-generation Peugeot 3008 compact SUV, the first Stellantis car on the STLA Medium platform that can be used for battery-electric and combustion engines variants. Stellantis will also begin sales of EVs from its Chinese partner Leapmotor in 9 European markets, including Germany, the U.K. and Italy, in September. (Reuters and Bloomberg contributed to this report)

- 605 risposte

-

- 2

-

-

-

- newco

- stellantis

-

(e 2 altri in più)

Taggato come: