-

Numero contenuti pubblicati

13064 -

Iscritto il

-

Ultima visita

-

Giorni Massima Popolarità

58

Tipo di contenuto

Forum

Galleria

Calendario

Download

Articoli del sito

Store

Blog

Tutti i contenuti di 4200blu

-

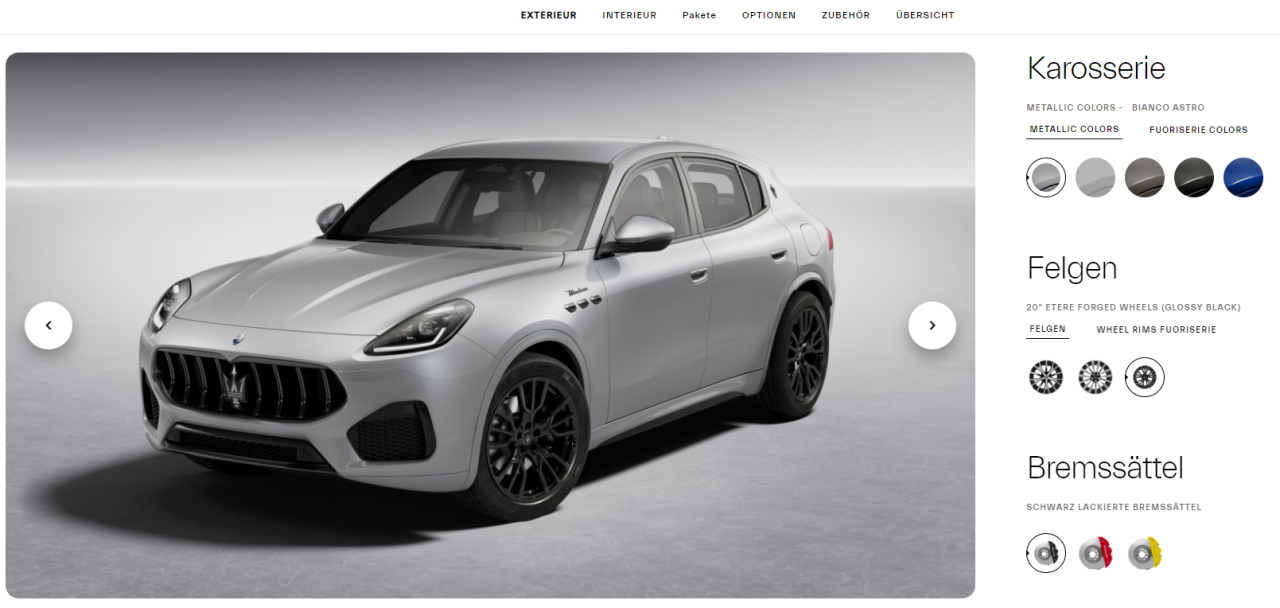

..esatto..gia la scelta nel configuratore con 5 colori e 3 cerchi in stile Peugeot oppure Panda dice tutto.....

- 147 risposte

-

- 6

-

-

-

- m6u

- mmxx

-

(e 35 altri in più)

Taggato come:

- m6u

- mmxx

- maserati 100% electric

- m9s

- m183

- m184

- maserati f-uv

- levante mca

- new v6

- maserati bev

- 2.0 phev

- nuove maserati

- nuovi modelli

- maserati spy

- 2.0 mhev

- maserati supercar

- quattroporte mca

- m156

- maserati

- maserati elettrica

- m240

- m189

- maserati ev

- m161

- future maserati

- maserati full electric

- quattroporte m183

- mmxxi

- m157

- maserati newgt

- levante m184

- maserati grecale

- grecale

- maserati mc20

- maserati d-uv

- ghibli mca

- folgore

-

si assolutamente d'accordo, ma adesso viene "on top" la politica di risparmio assoluto di Tavares e la Non-conoscenza del segmento lusso-sportivo di piccole serie. PSA sa solo come si produce macchine lowcost/generaliste in grande serie, ma come funziona e pensa un cliente del segmento upper-premium non hanno mai sentito. E neanche il venditore delle scarpe ginnastica.

- 147 risposte

-

- 4

-

-

-

- m6u

- mmxx

-

(e 35 altri in più)

Taggato come:

- m6u

- mmxx

- maserati 100% electric

- m9s

- m183

- m184

- maserati f-uv

- levante mca

- new v6

- maserati bev

- 2.0 phev

- nuove maserati

- nuovi modelli

- maserati spy

- 2.0 mhev

- maserati supercar

- quattroporte mca

- m156

- maserati

- maserati elettrica

- m240

- m189

- maserati ev

- m161

- future maserati

- maserati full electric

- quattroporte m183

- mmxxi

- m157

- maserati newgt

- levante m184

- maserati grecale

- grecale

- maserati mc20

- maserati d-uv

- ghibli mca

- folgore

-

Boh...Tipo combi per 2023 in tutta l'Europa ca. 8500 immatricolazioni - sembra assolutamente un business case in senso del modo di calcolare come Tavares 😂😂

-

Potrebbe andare avanti in Turchia, ma in Europa con GSR24 e UNECE (cybersecurity) non sembra molto logico di fare tutti questi aggiornamenti abbastanza cari per 1000 unite al mese per un oppure due altri anni.

-

Con solo ca. 1000 registrazione mensile durante gli ultimi tre mesi in tutta Europa la Tipo non e gia arrivata in stato "phase out"?

-

Si, si - due motori elettrici, 2x156Cv = 312Cv con la solita batteria a 54kWh e una autonomia reale di 150km.... 😂

- 2529 risposte

-

- 2

-

-

- alfa romeo

- stellantis

-

(e 1 altro in più)

Taggato come:

-

Configuratore online https://configure.mini.it/it_IT/configure/J01/21GC/FKXB4,P0C6K,S01QL,S0230,S0248,S02PA,S02VB,S02VC,S02XH,S0302,S0322,S0382,S0402,S0420,S0428,S0430,S0431,S0451,S0459,S0478,S0494,S04AA,S04FN,S04NR,S04T4,S04U8,S04U9,S04VF,S0548,S05A4,S05AC,S05AS,S05AT,S05AV,S05DN,S0654,S0688,S06AD,S06AE,S06AF,S06NX,S06PA,S06UQ,S07EP,S07YH,S0853,S087A,S08R3,S09T0

- 76 risposte

-

- mini cooper

- mini ufficiale

-

(e 6 altri in più)

Taggato come:

-

VW said to delay small EV volume production amid Euro 7 changes Softer Euro 7 anti-pollution rules mean small combustion-engine cars can now be sold for longer. BERLIN -- Volkswagen is delaying volume production of a new affordable battery-electric car because weaker Euro 7 anti-pollution rules mean that smaller cars with combustion engines will be allowed to be sold longer than anticipated, according to a German media report. The small EV, based on the ID.2all concept unveiled last March, is scheduled to go into full production in May 2026 instead of 2025, auto motor und sport reported. The production ID.2all will be sold at a base price of less than 25,000 euros ($27,200). The retail price will be higher than ICE rivals such as VW's own Polo that will be on the market at the same time. The Polo costs less than 22,000 euros in Germany. VW and other European automakers had anticipated that they would no longer be able to sell small ICE cars profitably by the end of the decade because of tough Euro 7 anti-pollution rules. After strong lobbying from the industry, EU countries have agreed not to change the existing Euro 6 test conditions and emissions limits for cars and vans, meaning that small ICE cars can continue to be built without costly upgrades that would make them unprofitable. However, the delay in volume production will put VW further behind European rivals such as Stellantis, which has launched the Citroen e-C3 full-electric small BEV that starts at 23,300 euros, and Chinese automakers that are targeting Europe with cheap electric cars. Production shake-up The ID2all's delay comes amid VW brand boss Thomas Schaefer's shake up of the automaker's production network in Europe to reduce costs. From now on, only 80 percent of the maximum forecast sales volume of a new model will be planned for production, Schaefer told auto motor und sport. VW's previous production planning included a buffer in case demand was higher than anticipated. For example, if the sales department estimated that they would sell 150,000 units a year of a new model, production was planned at 170,000 vehicles. Large overcapacities quickly arose when new orders collapsed, Schaefer said. He said if a new model had higher sales than forecast, the extra demand will be met by additional shifts. The new 80 percent planning is being used for the first time for production of the latest new Passat midsize model in Bratislava, Slovakia. "We will implement this for all future models and have already planned for it as part of the plant allocation," Schaefer said. (ANE)

- 66 risposte

-

- volkswagen id.2

- volkswagen

-

(e 4 altri in più)

Taggato come:

-

LCI in estate.

- 504 risposte

-

- serie 3 2019

- m3 2021

-

(e 11 altri in più)

Taggato come:

-

Questi dati sono solo immatricolazioni, non dicono niente per precorsa di contratti oppure tempi/data della produzione.

-

Secondo me un' altra X4 ice non ci sara. Credo che prossima X4 sara solo bev su Ncar.

-

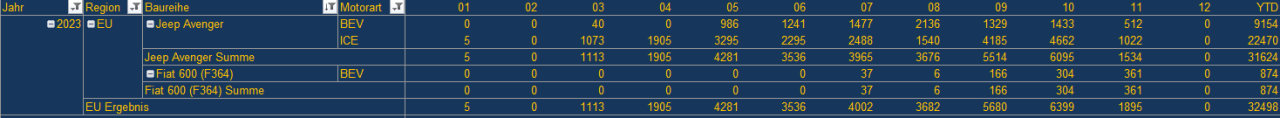

...ma se paragoni il ramp up Avenger bev con 600 bev, poi mi sembra che 600 e partita peggiore... (Novembre incompleto)

-

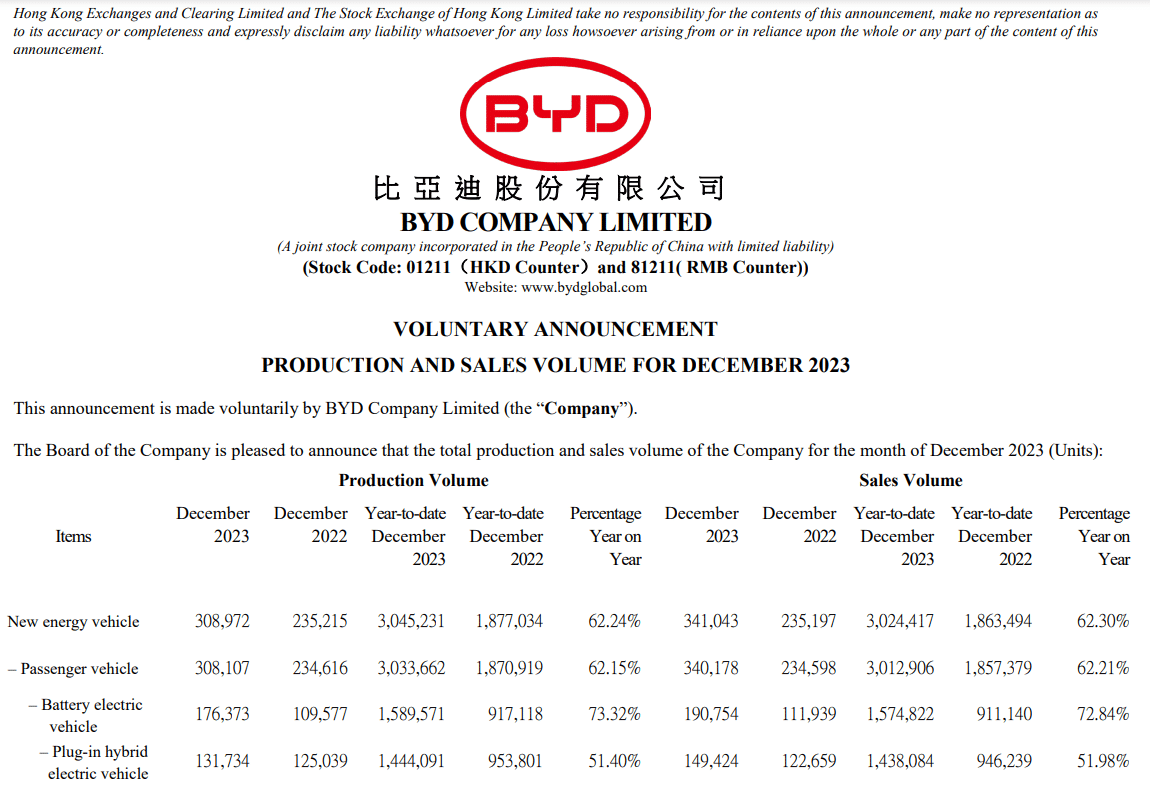

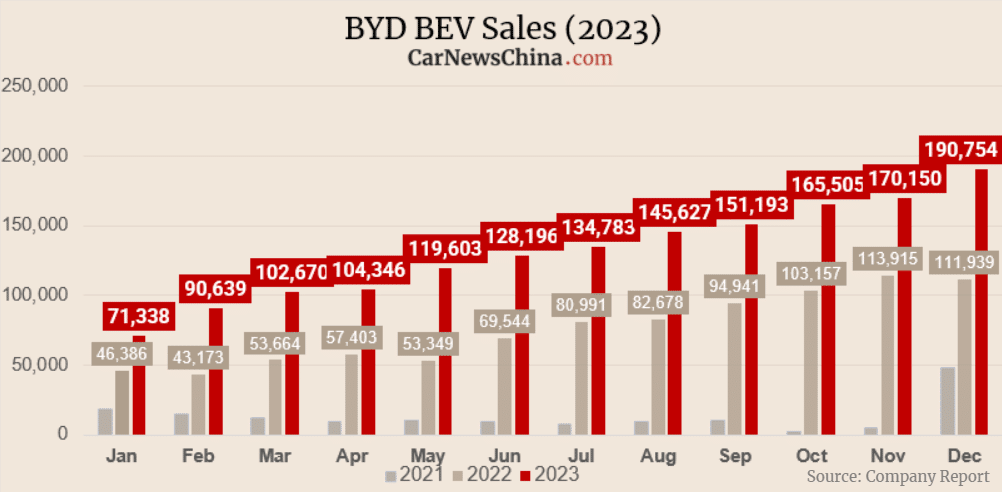

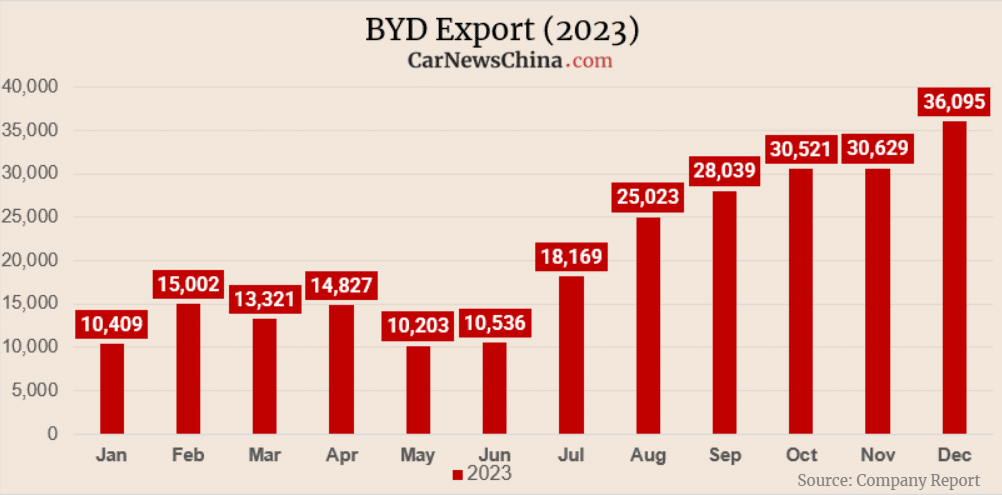

Tesla falls behind China's BYD in quarterly EV sales as growth slows BYD passed Tesla to become the new No. 1 in EVs, driven mainly by its much broader lineup of cheaper models in China. Tesla delivered more vehicles than expected in the fourth quarter, though not enough for the Elon Musk-led company to stay ahead of China's BYD in global electric-car sales. Tesla handed over 484,507 vehicles in the last three months, beating analysts' average estimate for 483,173 deliveries. The automaker delivered 461,538 Model 3 cars and Model Y crossovers, while it handed over about 23,000 units of its other models. BYD sold 526,409 fully electric vehicles in the quarter to become the new No. 1 in sales of BEVs, driven mainly by its much broader lineup of cheaper models in China. Tesla's record fourth-quarter deliveries came after a push to sell more Model 3 cars in the U.S. before some variants of the compact sedan lose federal tax credits in the New Year under the Inflation Reduction Act (IRA). Analysts had said that end of the tax incentives on some models was expected to bring sales forward into the fourth quarter. The rear-wheel drive and long-range variants of the Model 3 no longer have federal tax credits of $7,500 in the U.S. this year as updated requirements on battery material sourcing kick in, under the IRA. Tesla exceeded its target to deliver 1.8 million vehicles in 2023 but it came up well short of an upside scenario Musk touted 12 months ago. The CEO told analysts that the company had the potential to produce 2 million cars, but a series of price cuts failed to stoke enough demand to support that much output. The change in EV sales rankings reflects China's growing clout in the global automotive industry. After surpassing the U.S., South Korea and Germany the last few years, China may have overtaken Japan as the world's largest passenger-car exporter in 2023. Tesla generates more revenue and profit than BYD because it sells much higher-priced vehicles and relies on just two models for the lion's share of its sales. The Model Y SUV and Model 3 sedan accounted for 95 percent of deliveries in the fourth quarter. Musk expanded Tesla's lineup late last year, starting sales of the Cybertruck years behind schedule. The company didn't break out how many of the stainless steel-clad pickups it produced and delivered before year-end. The Cybertruck launch marked Tesla's entry into the highly competitive truck market in the U.S. Musk has cautioned that it may take the company 12 to 18 months to reach volume production and generate positive cash flow with the vehicle, which is difficult to build and packed with new technology. He said in October the company aims to produce about quarter of a million units of the electric pickup in 2025. The company said it expects to deliver 2.2 million vehicles in 2024, or an increase of about 22 percent, but slower than the growth of about 38 percent in 2023. Although Tesla doesn't break out quarterly vehicle sales by region, the U.S. and China are its largest markets. The company builds the Model S, X, 3 and Y in Fremont, California, and the Model 3 and Y in Shanghai. It also produces the Model Y at its plants in Austin and near Berlin, Germany. Tesla is due to report fourth-quarter results on Jan. 24 after markets close. (ANE)

-

- 147 risposte

-

- 3

-

-

-

Il tempo casa-casa normalmente non e meno (ecetto la tua casa e anche l'arrivo e a fianco dei aeroporti), i costi devo dire non mi interessano tanto e un volo e molto piu scomodo (stretto, bagaglio limitato che devi portare, mezzo pubblico con tanta altre gente, orario fisso) che la mia macchina privata che parte e ferma quando vorrei io.

-

BYD set to dethrone Tesla as top global EV seller China’s BYD Co. bills itself as the biggest car brand you’ve never heard of. It might need a different tagline soon. The automaker is poised to surpass Tesla Inc. as the new worldwide leader in fully electric vehicle sales. When it does — likely in the fourth quarter — it will be both a symbolic turning point for the EV market and further confirmation of China’s growing clout in the global automotive industry. In an industry still dominated by more familiar names such as Toyota Motor Corp., Volkswagen and General Motors Co., Chinese manufacturers including BYD and SAIC Motor Corp. are making serious inroads. After leapfrogging the U.S., South Korea and Germany over the past few years, China now rivals Japan for the global lead in passenger car exports. Some 1.3 million of the 3.6 million vehicles shipped from the mainland as of October this year were electric. “The competitive landscape of the auto industry has changed,” said Bridget McCarthy, head of China operations for Shenzhen-based hedge fund Snow Bull Capital, which has invested in both BYD and Tesla. “It’s no longer about the size and legacy of auto companies; it’s about the speed at which they can innovate and iterate. BYD began preparing long ago to be able to do this faster than anyone thought possible, and now the rest of the industry has to race to catch up.” Crown passed The passing of the EV sales crown also reflects the shift in competitive dynamics between Tesla’s Elon Musk, the world’s richest executive, and BYD’s billionaire founder, Wang Chuanfu. Whereas Musk has been warning that not enough consumers can afford Tesla EVs with such high interest rates, Wang is firmly on the offensive. BYD offers half a dozen higher-volume models that cost much less than what Tesla charges for its cheapest Model 3 sedan in China. When a Tesla owners’ club shared a clip in May of Musk snickering at BYD’s cars during a 2011 appearance on Bloomberg Television, Musk wrote back that BYD’s vehicles are “highly competitive these days.” The likely change in the global EV pecking order marks the realization of a goal that Wang, 57, set back when China was just starting to foster its now world-beating electric vehicle industry. While BYD continues to pull away from Tesla and all other auto brands at home, replicating its runaway success abroad is proving tricky. U.S. off limits Europe looks poised to join the U.S. in slapping Chinese car imports with higher tariffs to shield thousands of manufacturing jobs. Other countries’ EV markets are still in their infancy and aren’t nearly as lucrative. BYD management views the U.S. as virtually off-limits due to the escalating trade tensions between Washington and Beijing. Wang is no Musk — he eschews social media and largely steers clear of the limelight. But in an uncharacteristically brash address delivered weeks before the European Union opened an investigation into how China has subsidized its EV industry, Wang declared the time had come for Chinese brands to “demolish the old legends” of the auto world. While many car buyers outside of China are still only dimly aware of BYD, Warren Buffett surely isn’t. In 2008, Berkshire Hathaway Inc. invested about $230 million for an almost 10 percent stake in the Chinese automaker. When Berkshire started paring its holding last year — BYD shares were trading near their all-time high — the value of its stake had soared roughly 35-fold to around $8 billion. The late Berkshire Vice Chairman Charlie Munger saw BYD primarily as a battery play. On Bloomberg TV in May 2009, he said the company was working on “one of the most important subjects affecting the technological future of man.” Munger’s family had invested in the company years ahead of Berkshire, and he told an interviewer weeks before his death in November that he had tried to dissuade Wang from getting into the car business. BYD acquired a failing state-owned automaker in 2003 and introduced its first plug-in hybrid — called the F3DM — in 2008. A New York Times reviewer panned its exterior design, calling the compact “about as trendy as a Y2K-era Toyota Corolla.” The company sold all of 48 units in the first year. Around that time, China started subsidizing plug-in car purchases. Support from the government extended from cities and provinces to the national level, spanning tax breaks for consumers, production incentives for manufacturers, help with research and development, and cheap land and loans. As a rare automaker that also made its own batteries, BYD was uniquely positioned to benefit. Before entering the car business, it was the first Chinese lithium ion supplier to Motorola and Nokia in the early 2000s. To scale up output before consumers were embracing EVs, the company targeted automotive segments that would need lots of cells. Its first electric bus launched soon after the F3DM. “BYD was a miracle,” Munger told the podcast Acquired in an episode that aired in October. He called Wang a genius, saying he kept the company from going broke by working 70-hour weeks, and described him as a fanatical engineer. “The guy at BYD is better at actually making things than Elon is,” he said. Roughly a decade and a half into making cars, BYD had mustered the smarts to bring plug-in car prices down to levels comparable with combustion engine vehicles. But its lineup still lacked good looks. In 2016, the company hired Wolfgang Egger as design chief, a role he previously played for Audi and Alfa Romeo. It also lured away other international executives, including Ferrari’s head of exterior design and a top interior designer for Mercedes-Benz. By the time China invited Tesla to build the country’s first car plant fully owned by a foreign entity, BYD was no longer resigned to making no-frills econoboxes. Now, its most expensive model — the Yangwang U8 crossover — costs 1.09 million yuan ($152,600). While the level of government subsidies has played a role in China’s tremendous EV growth, Paul Gong, UBS Group AG’s head of China autos research, believes the bigger factor is the level of competition that the support spawned. “They have to work on the innovation, they have to try and find what consumers really want, and they have to optimize their costs to make sure their EVs are competitive in this highly competitive market,” Gong said. After tearing down a BYD Seal sedan and finding a 25 percent cost advantage over legacy competitors, his team concluded that Chinese manufacturers are likely to own a third of the global car market by the end of the decade. For now, Tesla still has BYD beat on key metrics including revenue, income and market capitalization. Analysts at Bernstein expect some of those gaps to close considerably in 2024 — they’re projecting Tesla will generate $114 billion in sales to BYD’s $112 billion. Anhui province roots Wang grew up the second youngest of eight children in the impoverished village of Wuwei in eastern China’s Anhui province. His parents died when he was a teenager, and his older siblings supported him through his high school and university education. Through the early years of his working life, Wang was based in Beijing, working as a mid-level government researcher on rare-earth metals critical to batteries and consumer electronics. He founded BYD in 1995 in Shenzhen with the help of an almost $300,000 loan from a friend. He’s now worth $14.8 billion, according to the Bloomberg Billionaires Index. Wang has racked up the air miles in 2023, crisscrossing the globe between auto shows, new market launches and meetings with heads of states. He’s touched down in countries including Japan, Germany, Vietnam, Brazil, Mexico and Chile — a travel schedule befitting the leader of a company that’s set up shop in some 60 countries and territories in just the last two years. Analysts expect BYD to launch its third-generation EVs next year offering more technology, such as automated-driving capabilities. That’s one area where BYD falls short with its more affordable products versus upstarts like Nio Inc. and Xpeng Inc. Even as the number of auto rivals in China has shrunk from over 500 to around 100, new entrants continue to emerge, including well-funded tech giant Huawei Technologies Co. When Bloomberg News asked Wang in March whether BYD had aspirations to be as big as Toyota, which in 2023 will be the world’s top-selling overall carmaker for a fourth straight year, he said the development of the EV industry will lead to an industry reshuffle. “How a car company performs will depend on its tech and response,” he said. “BYD in China’s electrification is the winner for now, but how it will go tomorrow, we can’t say for sure. But we will lean into our advantages and keep making good products.” But staying at the top will require a different mindset than getting there, said HSBC Qianhai Securities head of China autos Yuqian Ding. “When you become the No. 1, the mandate suddenly changes,” she said. “You’re going to redefine yourself — you’re going to have to find a way to beat yourself.” (ANE)

- 147 risposte

-

- 1

-

-

Hai mai fatto 800-900km in autostrada con velocita sempre tra 160-200km/h (ecetto i settori com limite) con una Fhev e hai paragonato il consumo per un viaggio cosi con quello di una diesel di grande cilindrata?

-

..almeno i naftoni made in Baviera saranno...

-

..mah..insieme con Zeekr, Polestar e Lotus sarebbe la possibilita per pianali, batterie e soluzioni software premium di volumi adeguati, invece in Stellantis, complesso low cost / generalista, una marca di lusso rimanera sempre un outsider senza nessun effetto delle sinergie utilizzabili.