-

Numero contenuti pubblicati

12944 -

Iscritto il

-

Ultima visita

-

Giorni Massima Popolarità

56

Tipo di contenuto

Forum

Galleria

Calendario

Download

Articoli del sito

Store

Blog

Tutti i contenuti di 4200blu

-

😂😂

- 149 risposte

-

- bmw ev

- elettrico bmw

-

(e 10 altri in più)

Taggato come:

-

G26-bev e la i4 😉

- 149 risposte

-

- 1

-

-

- bmw ev

- elettrico bmw

-

(e 10 altri in più)

Taggato come:

-

...a favore del successore Giulia spero di no, prendendo in considerazione lo SOP della G26 e lo SOP della Giulia II (o come si chiama) il benchmark per la nuova Alfa secondo me dovrebbe essere la NA0 - se no, poi e gia vecchia e dietro quando parte.

- 149 risposte

-

- 2

-

-

- bmw ev

- elettrico bmw

-

(e 10 altri in più)

Taggato come:

-

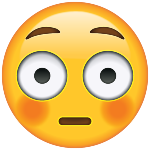

La i4 M50 ha una grande divaricazione del consumo tra modo di guidare prudente/economico e modo di guidare molto sportivo. AutoMotor&Sport a marzo (con temperature qui in germania sicuramente non ottime per una bev) ha avuto questi consumi: Guida eco - 21,7kWh/100km Pendolare (misto tra poco statale, autostrada e citta stop and go) - 29,3kWh Guida sportiva (statale sempre al limite permesso con sorpassi e autostrada con velocita fino a 200-210km/h dove permetto e possibile) - 39,4kWh, cosi solo 200km autonomia con questa stile di guida in inverno.

- 149 risposte

-

- bmw ev

- elettrico bmw

-

(e 10 altri in più)

Taggato come:

-

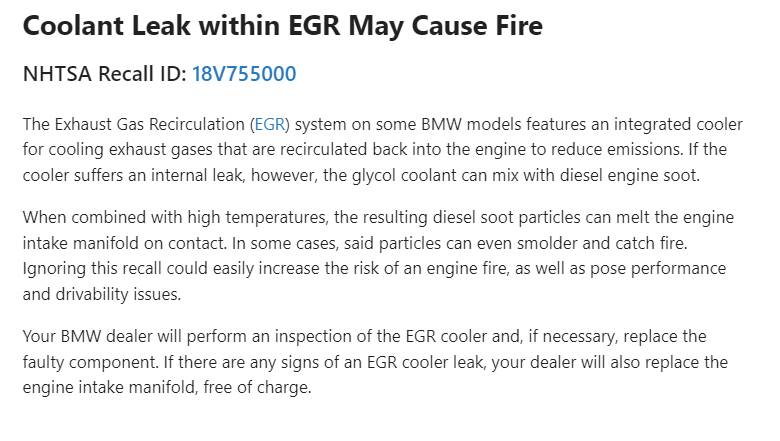

Non vorrei minimizzare o abbellire questo problema, per i clienti colpiti e senza dubbio una cosa grave. Solo, almeno come ho sentito io, al momento sembra davvero un problema di un piccolo lotto delle cellule Samsung, che hanno un difetto creato durante la produzione. Sono negli Stati 27 i4 e 56 iX, in Germania 30 i4 (di quelli 20 in mano clienti e 10 della parco aziendale BMW) che hanno montato battery packages che contengono cellule di questo lotto difettoso. Cosi sembra un problema serio ma puntuale (poco meno di 25.000 i4 prodotte fino adesso). Ma forse il tipo di costruzione di queste cellule e predisposto per problemi cosi e si deve aspettare che il problema si ripete, questo non posso valutare. Credo che Tu sai molto di piu come me per i dettaglie delle batterie diverse e le loro pro e con's.

- 149 risposte

-

- bmw ev

- elettrico bmw

-

(e 10 altri in più)

Taggato come:

-

...non funzionera mai....le auto, uguale se sono ice o bev, diventerano piu care......

- 634 risposte

-

- 2

-

-

- cobalto

- sostenibilità

- (e 8 altri in più)

-

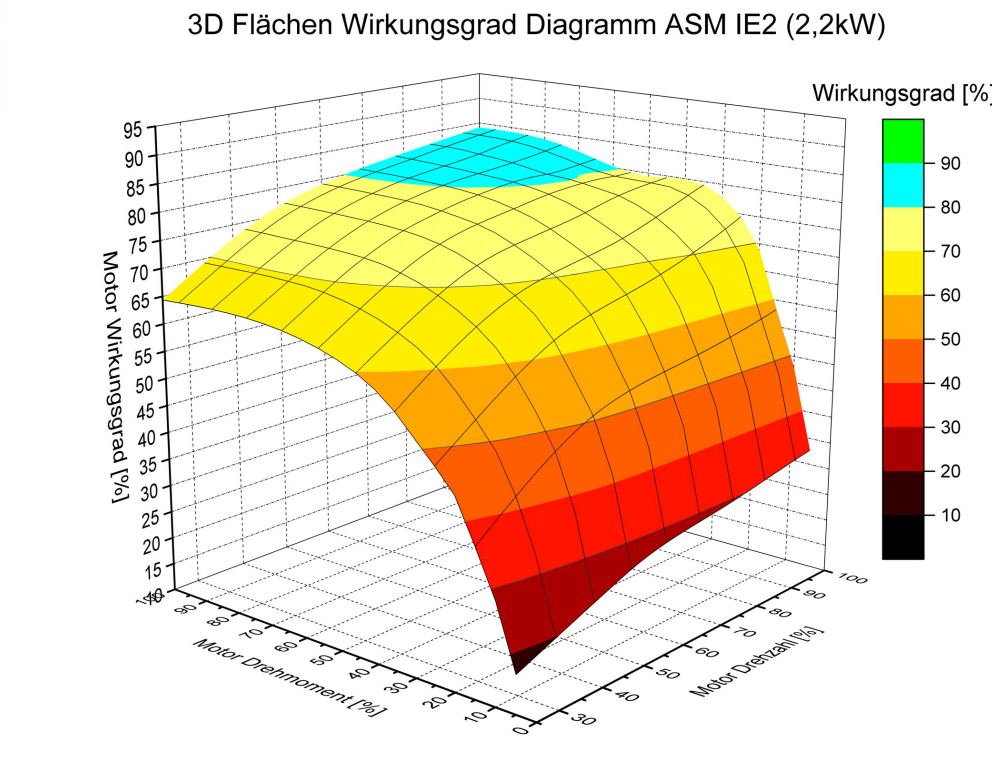

Dipende molto del tipo del motore elettrico (syncrono, asyncrono ecc.), ma detto generalmente: si, anche un motore elettrico non ha sempre la stessa efficienza per le giri diversi. Credo che @Maxwell61 potrebbe spiegare molto meglio come io. Un esempio di un motore asyncrono (fonte keNext)

- 634 risposte

-

- 2

-

-

-

- cobalto

- sostenibilità

- (e 8 altri in più)

-

Renault's electric push is on right track, CEO de Meo says Renault's latest full-electric car, the Megane E-Tech, was France's best-selling EV in July. Renault CEO Luca de Meo said the uptake of the new Megane E-Tech compact electric car shows the automaker is on the right track with its turnaround at a time of increased challenges for the automotive industry. Renault sold 25,000 Megane E-Tech vehicles in three months, de Meo told Le Journal du Dimanche in an interview published in its Sunday edition. Total new car registrations have fallen this year in France. "The democratization of the electric car will take place in Europe and involves products at affordable prices," de Meo told the newspaper. Still, costs are rising for materials needed for EV batteries and that means the "equation is hard," he said. The Megane E-Tech model, which is being widely advertised in French media, was the country’s best-selling EV in July, according to data by Avere-France. Renault is counting on a series of new EV models to take on bigger rivals such as Volkswagen and Stellantis as European carmakers battle a shortage in semiconductors and rising inflation that could impact consumers' ability to spend money on costlier electric vehicles. Renault on July 29 raised its outlook for 2022 after posting a net loss in the first half of the year. "Our first half performance and hiked full-year guidance should quieten those who said Renault could not survive," de Meo told JDD. Renault's “restructuring and strong execution are paying off," Bernstein & Co. analyst Daniel Roeska wrote in an Aug. 4 note to clients. Still, “tides may turn in 2023” as the carmaker faces multiple headwinds, he said. De Meo has said he will give more details on his plan to carve out Renault's electric and combustion-engine businesses in the fall. (Bloomberg)

- 154 risposte

-

- megane

- renault mégane e-tech electric 2022

- (e 8 altri in più)

-

Chipmakers have a message for automakers: Your turn to pay Many semiconductor executives point the finger at automakers' lack of understanding of how the chip supply chain works. The shortages of computer chips that forced global automakers to scrap production plans for millions of vehicles over the past two years are easing -- at a new and permanent cost to the car companies. What had been "war room operations" to manage chip shortages are becoming embedded features of vehicle development, say executives in both industries. That has shifted the risks and some of the costs to automakers. Newly created teams at the likes of General Motors, Volkswagen Group and Ford Motor are negotiating directly with chipmakers. Automakers such as Nissan and others are accepting longer order commitments and higher inventories. Key suppliers including Robert Bosch and Denso are investing in chip production. GM and Stellantis have said they will work with chip designers to design components. Taken together, the changes represent a fundamental shift for the auto industry: higher costs, more hands-on work in chip development and more capital commitment in exchange for better visibility in their chip supplies, executives and analysts say. It is a U-turn for automakers who had previously relied on suppliers -- or their suppliers -- to source semiconductors. For chipmakers, the still-developing partnership with automakers is a welcome -- and overdue reset. Many semiconductor executives point the finger at automakers' lack of understanding of how the chip supply chain works -- and an unwillingness to share cost and risk -- for a large part of the recent crisis. The costly changes are coming together just as the auto industry appears to be moving past the worst of an even more costly crisis that by one estimate has cut 13 million vehicles from global production since the start of 2021, AutoForecast Solutions (AFS) estimates. 'Behave like my best friend' C.C. Wei, CEO of the world's biggest chipmaker, Taiwan Semiconductor Manufacturing, said he had never had an auto industry executive call him -- until the shortage was desperate. "In the past two years they call me and behave like my best friend," he told a laughing crowd of TSMC partners and customers in Silicon Valley recently. One automaker called to urgently request 25 wafers, said Wei, who is used to fielding orders for 25,000 wafers. "No wonder you cannot get the support." Said Sam Fiorani, vice president of global vehicle forecasting at AFS: "It's an arrogant industry. Sometimes it just bites them in the rear." Thomas Caulfield, GlobalFoundries chief executive, said the auto industry understands it can no longer leave the risk of building multibillion-dollar chip factories to chipmakers. "You can't have one element of the industry carry the water for the rest of the industry," he told Reuters. "We will not put capacity on unless that customer is committed to it, and they have a stake of ownership in that capacity." Ford has announced it will work with GlobalFoundries to secure its supply of chips. Mike Hogan, who heads GlobalFoundries' automotive business, said more deals like that are in the pipeline with other car makers. SkyWater Technology, a chip manufacturer in Minnesota, is talking to automakers about putting "skin in the game" by buying equipment or paying for R&D, CEO Thomas Sonderman told Reuters. Working closer with autoakers and their suppliers has brought onsemi $4 billion in long-term agreements for power management chips made from silicon carbide, a new material gaining popularity, CEO Hassane El-Khoury said. "We're making billions of dollars of investment every year in order to scale that operation," he told Reuters. "We're not going to build factories on hope." Michael Hurlston, the CEO of Synaptics, whose chips drive touchscreens, which had held up some auto production, said the recent, more direct collaboration with automakers could create new business opportunities as well as managing risks. Hurlston said the automotive industry has warmed up to using OLED screens, which are less durable than the LCD screens, a factor that many perceived would limit their use in cars despite better contrast and lower power consumption. "But that perception has changed pretty dramatically over the last two years. And that perception has changed as a direct result of us being able to talk to (the auto industry)," he said. "The paradigm has really, really shifted for us." Chief executives of Japan's Renesas Electronics and Dutch NXP Semiconductors have both told Reuters they are co-locating engineers to help automakers design a new architecture where one computer would centrally control all functions. "They have woken up," said NXP CEO Kurt Sievers. "They have understood what it takes. They try to find the right talent. It's a big shift." Part of the chip industry The average semiconductor content per vehicle will exceed $1,000 by 2026, doubling from the first year of the pandemic, according to Gartner. One example: the battery-powered Porsche Taycan has more than 8,000 chips. That will double or triple by the end of the decade, according to Volkswagen. "We have understood that we are a part of the semiconductor industry," said VW Group's Berthold Hellenthal, a senior manager for semiconductor management. "We have now people dedicated just to strategic semiconductor management." Securing -- and keeping -- chip engineers will be a challenge for automakers, which will have to compete against the likes of Alphabet's Google, Amazon and Apple, said Evangelos Simoudis, a Silicon Valley venture capital investor and adviser who works with both established automakers and startups. "I think that that would lead to acquisitions," he said. Unlike Tesla, which designs its own core chips, Simoudis said traditional automakers will have to juggle production of legacy auto models as they make new investments. (Reuters)

- 168 risposte

-

- 2

-

-

- crisi materie prime

- materie prime

-

(e 4 altri in più)

Taggato come:

-

come hanno fatto in questione legale e economico? Hanno avuto una relazione cliente-fornitore? Chi era il cliente/mandante e chi era fornitore? Non puoi lavorare insieme con due soggetti legali diversi senza contratto. Quando FCA ha lavorato con Magna-Steyr, FCA era mandante e Magna era fornitore/partner di sviluppo. FCA ha delegato, e pagato, Magna ha consegnato. In quale direzione ha funzionato questo mechanismo tra i R&D di FCA e PSA prima della fusione?

- 342 risposte

-

- emotors m3

- stellantis tecnologia

- (e 3 altri in più)

-

G3 e P7 sono gia arrivati a Norvegia.

-

...ah...grazie, anche se non sembra molto consapevole dei costi avere in produzione due 6cil completamente diversi, non sembra in linea con il modo di pensare di Tavares in altri domande della razionalizzazione della produzione. ...ripetono cosa hanno gia fatto come "blue print" a Rüsselsheim.

-

Domanda: se investono nella linea di Pentastar V6, significa che la nuova inline 6 e morto? O vogliono fare due 6cil parallelo?

-

- 634 risposte

-

- cobalto

- sostenibilità

- (e 8 altri in più)

-

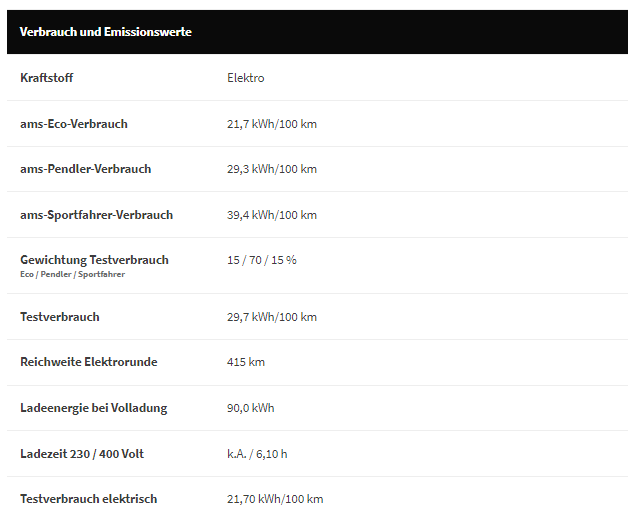

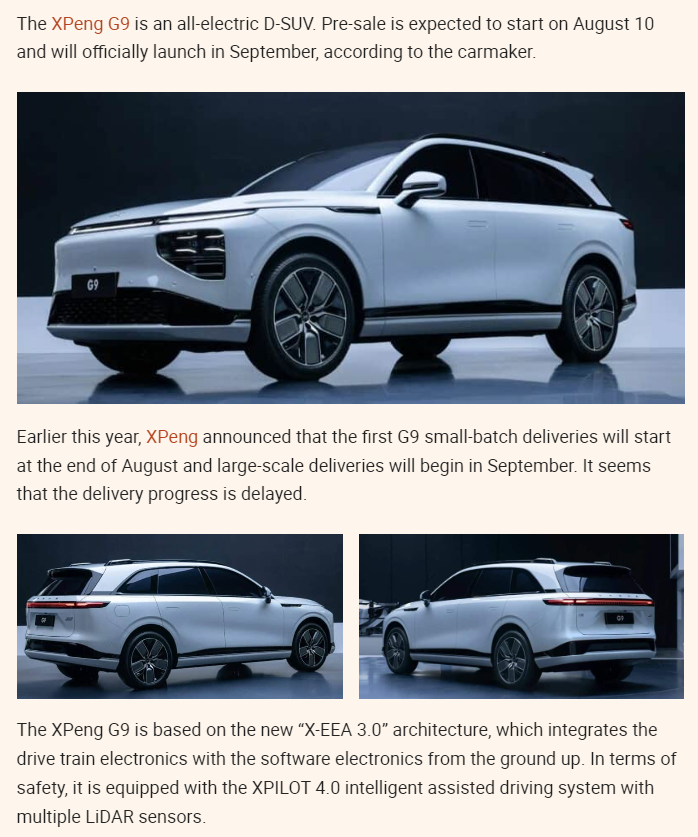

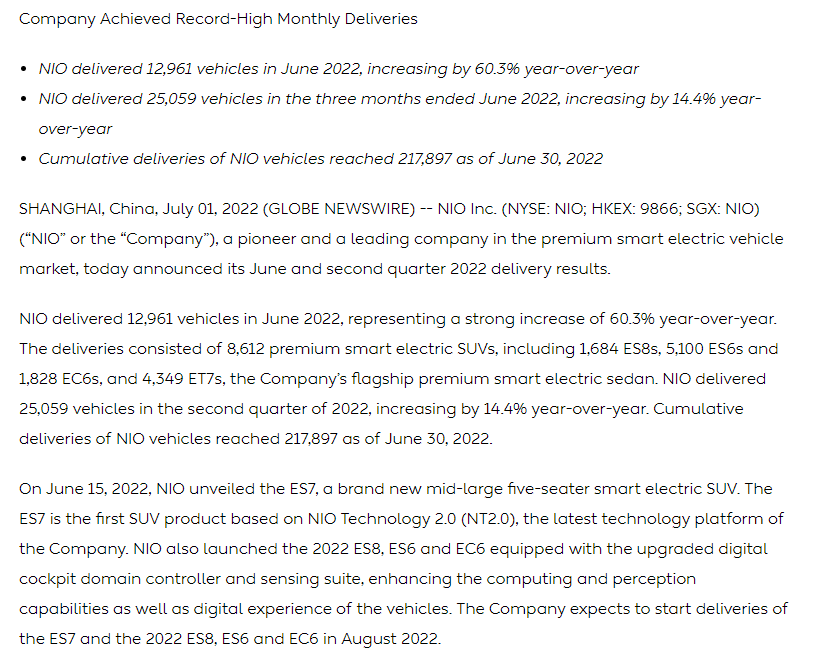

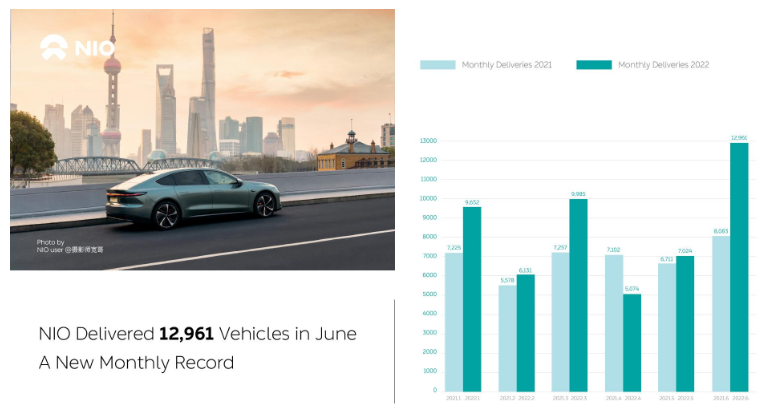

Secondo me tra qualche anni, questi cinesi, BYD, Nio, Xpeng e Zeekr saranno un bel compito per gli europei.

-

Forse ordinabile, ma disponibile non potrebbe essere, perche SOP sara tra qualche mesi piu avanti, contemporaneo per tutti versioni (ECE, ECE RHD, US) 😉

- 149 risposte

-

- 1

-

-

- bmw ev

- elettrico bmw

-

(e 10 altri in più)

Taggato come:

-

BMW's Neue Klasse electric architecture will arrive in 2025, and as of today, we know a 3 Series sedan will be the opening act. Whether it officially becomes the new 3 Series isn't entirely clear, but an interesting rumor has the popular sedan existing simultaneously on two platforms going forward – one for electricity, the other for internal combustion. The rumor comes from BMW Blog, citing an anonymous but reliable source for the information. The car would become the G50 / G51 3 Series, riding on BMW's CLAR modular platform for internal combustion and hybrid powertrains. It would coexist with the Neue Klasse electric 3er, likely called the i3, rumored to have an internal designation of NA0. And it wouldn't launch until 2027. It's quite an interesting notion, though BMW isn't ready to talk about such possibilities. In an email to Motor1.com, a BMW spokesperson declined to comment on our inquiry about this rumor. The current 3 Series debuted at the Paris Motor Show in 2018 and just received a mid-cycle refresh that was announced in May. The update brought minor exterior tweaks to the front and rear, offset with a significant tech upgrade inside featuring a large curved screen containing two displays for the driver and center touchscreen. If BMW follows its typical lifecycle for vehicles, a new model would arrive in 2025. That's perfect timing for the Neue Klasse platform to take over, but the rumor poses a relevant question: is BMW ready to take the 3 Series all-electric in the next couple of years? That's the foundation for the rumor, and at this time, there's no clear indication that BMW's new platform will accommodate internal combustion powertrains. It's certainly possible that BMW could extend the current G20 3 Series lifespan, and in fact, that's also been a rumor on BMW Blog. Bumping to 2027 would give buyers a few years of overlap to get comfortable with electric power. Building a next-generation 3 on the CLAR platform would extend the overlap while giving buyers a choice of pure electric and hybrid vehicles for at least another decade. The literal million-dollar question is whether an i3 on the Neue Klasse platform and a 3 Series on CLAR would be worth the investment. (Motor1 USA)

- 255 risposte

-

- 1

-

-

- rolls-royce

- scelte strategiche

-

(e 2 altri in più)

Taggato come:

-

NEWARK, CA — August 3, 2022 — Lucid Group, Inc. (NASDAQ: LCID), setting new standards with the longest-range, fastest-charging electric car on the market, today announced financial results for its second quarter ended June 30, 2022. Lucid reported Q2 revenue of $97.3 million on deliveries of 679 vehicles. The Company reported strong customer demand for Lucid Air with reservations over 37,000 as of today, representing potential sales of approximately $3.5 billion. Lucid revised its 2022 production volume outlook to a range of 6,000 to 7,000 vehicles. Lucid ended the quarter with $4.6 billion cash, cash equivalents, and investments, which is expected to fund the Company well into 2023. In addition, Lucid reported first half production of 1,405 vehicles. “Our revised production guidance reflects the extraordinary supply chain and logistics challenges we encountered,” said Peter Rawlinson, Lucid’s CEO and CTO. “We’ve identified the primary bottlenecks, and we are taking appropriate measures – bringing our logistics operations in-house, adding key hires to the executive team, and restructuring our logistics and manufacturing organization. We continue to see strong demand for our vehicles, with over 37,000 customer reservations, and I remain confident that we shall overcome these near-term challenges.” “Our Q2 revenue was $97.3 million, primarily driven by higher customer deliveries of Lucid Air vehicles. We continue to have a strong balance sheet, closing the quarter with $4.6 billion cash, cash equivalents and investments, which we believe is sufficient to fund the Company well into 2023,” said Sherry House, Lucid’s CFO. “Despite our immediate challenges, we believe that bringing our logistics center on-site at our Arizona factory will help reduce complexity, cut down lead times, and reduce various costs.” Lucid will host a conference call for analysts and investors at 2:30 P.M. PT / 5:30 P.M. ET on August 3, 2022. The live webcast of the conference call will be available on the Investor Relations website at ir.lucidmotors.com. Following the completion of the call, a replay will be available on the same website. Lucid uses its ir.lucidmotors.com website as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. About Lucid Group Lucid’s mission is to inspire the adoption of sustainable energy by creating advanced technologies and the most captivating luxury electric vehicles centered around the human experience. The Company’s first car, Lucid Air, is a state-of-the-art luxury sedan with a California-inspired design that features luxurious full-size interior space in a mid-size exterior footprint. Underpinned by race-proven battery technology and proprietary powertrains developed entirely in-house, Lucid Air was named the 2022 MotorTrend Car of the Year®. The Lucid Air Grand Touring features an official EPA estimated 516 miles of range or 1,050 horsepower. Deliveries of Lucid Air, which is produced at Lucid’s factory in Casa Grande, Arizona, are currently underway to U.S. customers. (Lucid Group Inc.)

- 198 risposte

-

- 1

-

-

- zev

- lucid motors

-

(e 6 altri in più)

Taggato come:

-

-

VW Golf 9 in doubt due to rising costs with development of ICE cars In March 2021, Volkswagen was eager to announce that the Golf, T-Roc, Tiguan, and Passat would all get next-generation models. That statement might have been a bit premature in the case of the compact hatchback/estate duo as the company's newly appointed CEO remains cautious about the Golf's future. In an interview with the German paper Welt, Thomas Schäfer said a decision about developing a ninth-generation model has not been taken yet. Skoda's former head honcho took the reins of the VW core brand on April 1 this year and is questioning the Golf's future because of increasing costs with the development of cars equipped with combustion engines. Euro 7 regulations are expected to arrive in the coming years, and these will drive up the prices of an ICE-powered car by €3,000 to €5,000, according to Schäfer. He went on to say the end is nigh for €10,000 cars in Europe because making combustion engines comply with the stricter legislation regarding emissions will increase development costs. VW's top brass announced a mid-cycle facelift is being worked on for the current Golf, but an Mk9 is uncertain at this point. He pointed out that engineering a new ICE car that is unlikely to have the traditional life cycle of 7-8 years might not be worth it, adding it's "extremely expensive" to develop Euro 7-compliant vehicles. Reading between the lines, his statement about the Golf 9 not being sold for the full seven to eight years is related to the sales ban on new cars equipped with petrol or diesel engines that will come into effect in the European Union in 2035. The current-generation model has been around since 2019 and is likely to receive a facelift in 2023/2024 that would be sold for another three to four years. A potential Golf Mk9 would therefore arrive in 2027 or so, meaning its demise could coincide with the death of the ICE in the EU. Some Euro markets could decide to switch to EVs sooner than that, consequently impacting sales of the Golf by limiting its availability. Thomas Schäfer said a final decision regarding whether there will be a ninth Golf will be taken in the next 12 months. He said that with small cars, it's tricky to offset the higher development costs that come with Euro 7, so we can deduce the future is not looking great for the ICE-powered Polo supermini either. In fact, Audi has already said it will bid adieu to the mechanically related A1 after this generation, with the Q2 subcompact crossover also going the way of the dodo. (Motor1 UK)

- 1064 risposte

-

- 4

-

-

-

-

- italdesign

- jetta

-

(e 15 altri in più)

Taggato come:

-

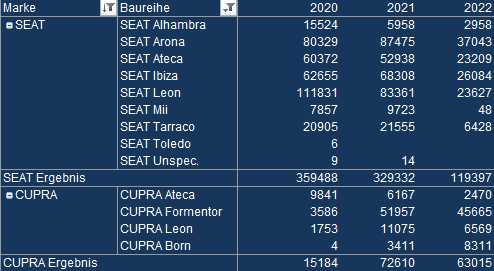

Seat smetterà di produrre auto

nella discussione ha aggiunto 4200blu in Notizie e Scelte Strategiche dal mondo dell'Auto

...secondo me Seat come brand morira insieme con i motori ice.... -

- 3060 risposte