-

Numero contenuti pubblicati

12969 -

Iscritto il

-

Ultima visita

-

Giorni Massima Popolarità

56

Tipo di contenuto

Forum

Galleria

Calendario

Download

Articoli del sito

Store

Blog

Tutti i contenuti di 4200blu

-

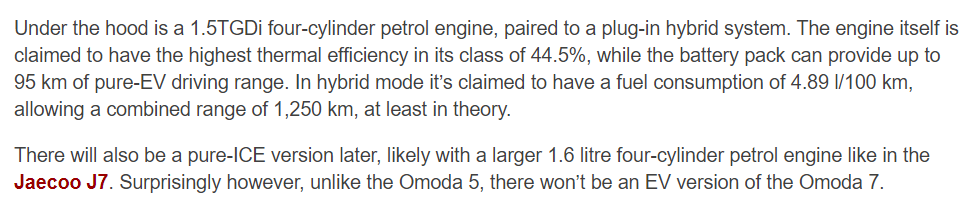

...ma hanno spiegato in quell modo hanno fatto questa calcolazione? Volume di brand cinesi oppure davvero auto fatte prodotte in Cina, quindi anche iX3, Mini, Smart 1 ecc. ecc. ?

-

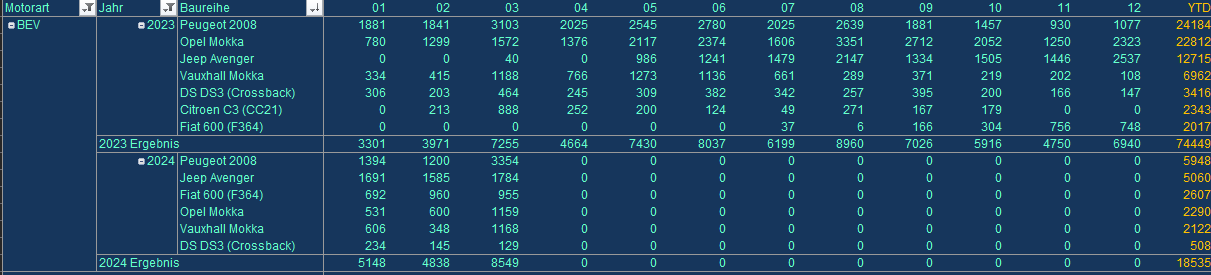

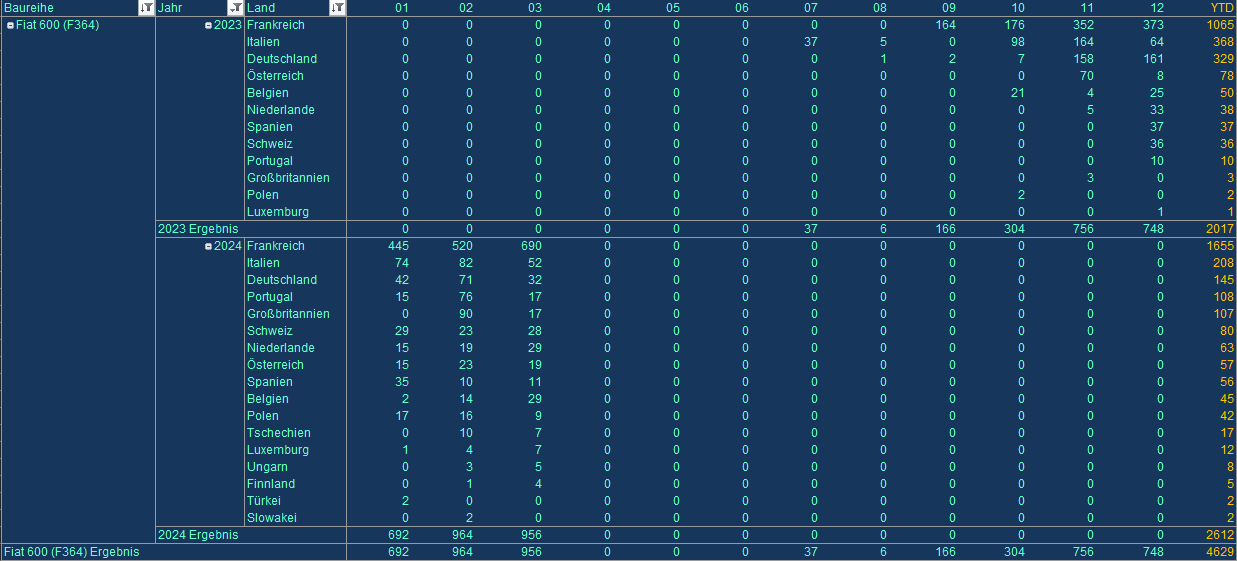

Secondo me il ramp up (almeno della bev) e finito, sono arrivati a ca. 1000 unite al mese con vendite di ca. 60-70% in Francia.

-

Non e una questione di preferire quale, la Panda attuale semplicemente non e piu immatricolabile dopo il 30 giugno per mancanza delle Adas.

- 186 risposte

-

- mhev

- fiat ufficiale

-

(e 8 altri in più)

Taggato come:

-

Musk dismisses Tesla senior executives in fresh job cuts, report says Tesla is cutting more than 10% of its workforce. Elon Musk is said to be frustrated by falling sales and the pace of job cuts so far. Elon Musk has dismissed two Tesla senior executives and plans to lay off hundreds more employees, frustrated by falling sales and the pace of job cuts so far, The Information reported on Tuesday, citing the CEO's email to senior managers. Rebecca Tinucci, senior director of the electric vehicle maker's Supercharger business, and Daniel Ho, head of the new vehicles program, will leave on Tuesday morning, the report said. Musk also plans to dismiss everyone working for Tinucci and Ho, including the roughly 500 employees who work in the Supercharger group, The Information said. It was not clear how many employees worked for Ho. Tesla's public policy team, which was led by former executive Rohan Patel, will also be dissolved, the report said. "Hopefully these actions are making it clear that we need to be absolutely hard core about headcount and cost reduction," Musk wrote in the email, the report said. "While some on exec staff are taking this seriously, most are not yet doing so." Tesla, which had 140,473 employees globally as of end-2023, did not immediately respond to a Reuters' request for comment. Ho joined Tesla in 2013 and was a program manager in the development of the Model S, the 3, and the Y before being put in charge of all new vehicles, while Tinucci joined in 2018 as a senior product manager, according to their LinkedIn profiles. Two other senior leaders -- Patel and battery development chief Drew Baglino -- announced their departures earlier this month, when Tesla also ordered the layoffs of more than 10 percent of its workforce. Tesla is grappling with falling sales and an intensifying price war, which led to its quarterly revenue falling for the first time since 2020, the company reported last week. Musk made progress towards rolling out Tesla's advanced driver-assistance package in China, the epicenter of the EV price war, during a surprise visit to Beijing on Sunday. That trip came just over a week after he scrapped a planned trip to India, where Tesla has long sought to start operations, due to "very heavy Tesla obligations." (ANE)

-

..secondo Motorsport-Total.com il time-line potrebbe essere cosi: Secondo Motorsport.com, Newey ha un contratto con la Red Bull fino al 2027 e, se il team applicherà il cosiddetto “gardening leave”, sarà mandato in congedo retribuito fino alla scadenza del contratto e non potrà iniziare a lavorare altrove in Formula 1. Questo ritardo ridurrebbe al minimo l'influenza di Newey fino all'inizio del 2028, ben oltre il prossimo ciclo regolamentare, quando i team saranno già al lavoro per le prossime sfide regolamentari. Questo ritardo ridurrebbe al minimo l'influenza di Newey fino all'inizio del 2028, ben oltre il prossimo ciclo regolamentare, quando i team avranno già lavorato duramente alle loro prossime sfide regolamentari. Questo è probabilmente il motivo per cui stanno lavorando insieme a una soluzione, dato che Newey vuole andarsene alla fine dell'anno e iniziare con una nuova squadra. Tradotto con DeepL.com (versione gratuita)

-

- 1151 risposte

-

- maserati ufficiale

- granturismo 2023

- (e 8 altri in più)

-

- 12 risposte

-

- 1

-

-

- 1065 risposte

-

- italdesign

- jetta

-

(e 15 altri in più)

Taggato come:

-

Why BYD's EV exports sell for twice the China price BYD sometimes charges more than double or triple its China sticker prices for its vehicles abroad. LONDON -- U.S. and European politicians have raised alarms that their domestic auto industries could be destroyed by a wave of cheap Chinese electric vehicles. But so far, China's top EV maker, BYD, has dramatically hiked export prices compared to what it charges at home rather than undercut foreign rivals. The goal: to rake in hefty profit margins the automaker cannot get in China amid fierce competition. In some foreign showrooms, BYD charges more than double — sometimes nearly triple — the price it gets for three key models in China, according to a Reuters review of the automaker’s pricing in five of its biggest export markets. Take the BYD Atto 3, a compact electric crossover. In China, the midrange version sells for $19,283. In Germany, the little SUV is priced at $42,789 — a price that is still competitive with comparable electric vehicles in that market. BYD did not respond to a request for comment. Company Chairman Wang Chuangfu in March told investors in a private meeting that BYD expects exports to help shore up profitability this year as a domestic price war weighs on its margins. It’s common for automakers to charge slightly different prices for exports of the same or similar versions of a vehicle. But the sheer size of BYD’s upcharges for overseas markets is rare, said Sam Fiorani, vice president of global forecasting at market research firm AutoForecast Solutions. “Globally marketed vehicles are usually priced in a narrow range,” Fiorani said. The differential, in part, reflects cutthroat competition in China, the world’s largest auto market, where dozens of EV brands are waging a price war. BYD’s entry-level Seagull electric hatchback sells for less than $10,000 at home. BYD’s big export markups also underscore the massive cost advantages that China’s EV industry has over foreign competitors. China’s EV leader has squeezed costs from every stage of production, from raw materials to batteries, land and labor, according to experts on China's auto industry and battery-cost data provided to Reuters. In addition, Beijing has heavily subsidized both domestic and foreign brands selling EVs in China, where electric and plug-in hybrid vehicles accounted for more than a third of all new car sales last year. This cost edge has foreign competitors nervous. Some U.S. and European automakers are calling for higher tariffs on Chinese EVs. BYD and other Chinese EV makers are already expanding in Europe but do not yet sell in the U.S., where they face higher tariffs and stiffer political resistance. China’s domination of the global EV industry is on display this week at the Beijing International Automotive Exhibition, where BYD showed off two luxury models as part of a strategy to capture the premium market. Automakers are expected to launch 110 new EV and plug-in hybrid models in China this year, most from Chinese brands. Hiking export prices gives BYD room to generate much larger profits per vehicle, experts in EV manufacturing costs told Reuters. But those margins also give the automaker enormous flexibility to cut prices if needed to grab market share abroad. For now, Chinese automakers, led by BYD, are content to keep export prices elevated and reap the profits, said Ben Townsend, head of automotive at U.K.-based Thatcham Research, an industry-funded firm that works on safety issues with automakers, including some from China. He said Chinese EV makers often struggle to break even or squeeze out a small profit in their home market. "They are not looking to undercut the European market,” he said. “They are looking to make margin." BYD and other EV makers are also trying to shed the stigma of cheap Chinese products as they build global reputations and focus on maintaining strong resale values, said Bo Yu, Greater China country manager for U.K. research firm JATO Dynamics. "Chinese automakers are in a brand-development phase," she said. Massive markups Reuters reviewed pricing published by BYD or its dealers in five of its leading export markets — Germany, Brazil, Israel, Australia and Thailand — that commonly offered three of its most popular electric vehicles, the Dolphin and Seal sedans, and the Atto 3 SUV. In one case, Israel, the Seal was not offered. Across those markets, the starting price for the BYD Atto 3 ranged from 81 percent to 174 percent higher than in China. Dolphin prices ranged from 39 percent to 178 percent higher, and Seal prices from 30 percent to 136 percent higher. Comparing starting prices by market is complicated by regional differences in available trim levels. In some cases, entry-level exported vehicles examined by Reuters had slightly better equipment than the lowest-priced model in China. In cases where apples-to-apples comparisons were possible at various trim levels, BYD’s export prices typically were still much higher than in China. For instance, the closest version of the Dolphin on sale in Germany, with the same battery range, sells for $37,439 — more than double the $16,524 price tag in China. The upgraded Seal version sells for $48,139 in Germany, 59 percent more than its $30,317 China price. By comparison, the Reuters analysis found that Tesla, which has a higher cost base than Chinese rivals, sells its Chinese-made Model 3 for only 37 percent more in Germany than in China, according to Tesla’s web site. Automakers can face hefty costs in exporting cars. But BYD’s large export premiums are more than enough to cover them and deliver thousands of dollars in additional profit per vehicle, according to an analysis conducted for Reuters by A2MAC1, which disassembles cars for automakers to assess their competitors’ products. Based near Paris, A2MAC1 examined the European version of the BYD Dolphin, which sells for about $35,000, and a China version selling for about $15,000. The European Dolphin is slightly longer and has extra features, including a slightly bigger battery, a more comfortable suspension and additional sensors. Still, accounting for those upgrades, along with shipping and import taxes, A2MAC1 estimated that BYD’s profit margin on the European car was about $7,400 more than whatever it clears on the same car in China. ‘Bargaining power’ BYD has emerged as the dominant player in China's electric-vehicle market. It's now investing heavily and growing sales in markets worldwide. Its 2023 exports of 240,000 cars accounted for 8 percent of its 3 million in global sales. But the automaker is swiftly adding new models and new markets and says exports should jump to 400,000 cars this year. The Reuters review of Chinese EV model prices in Europe revealed that Chinese automakers often price their vehicles just slightly below or above legacy European rivals, while stuffing them with interior and tech features for which European automakers charge extra. The top version of the BYD Atto 3 in Germany sells for $42,789, just below the base model of the electric Opel Mokka at $43,652, but above the $41,298 starting price for a Peugeot E-2008. Sometimes BYD shoots higher than competitors. It sells an upgraded version of the Seal in Europe for 10 percent more than the roughly comparable Tesla Model 3. In China, the Seal is priced at 6 percent less than the Tesla. BYD has an advantage over legacy automakers with its vertically integrated supply chain. It makes almost all components of its cars in-house rather than farming them out to suppliers. Lowering the cost of batteries — an EV's most expensive component — has been key. BYD and other Chinese automakers and suppliers have spent the last two decades securing access to mines around the world to lock up critical battery minerals such as lithium and cobalt, said Keith Norman, chief sustainability officer at Silicon Valley battery startup Lyten. "They own the critical-minerals part," Norman said. Data provided to Reuters by market intelligence firm Benchmark Mineral Intelligence, shows the price for batteries in China to be around 18 percent lower this year than in Europe. A giant company like BYD, which makes its own batteries, can drive its costs even lower by negotiating volume discounts across the battery supply chain, said Benchmark analyst Roman Aubry. Chinese automakers are helped by affordable land — often subsidized by local authorities — and benefit from cheaper electricity and labor. They can also build plants in China in as little as a year because they face fewer regulatory hurdles than in Western countries, according to Mark Wakefield, head of the global automotive practice at AlixPartners, a New York-based consultancy. That means Chinese automakers’ capital investment is far lower per vehicle, “and you make more money," he said. (ANE)

- 146 risposte

-

- 2

-

-

-

EXCLUSIVE Tesla in talks with Baidu Apollo, explores robotaxi launch in China, sources say Tesla and Baidu Apollo hold exploratory talks regarding the robotaxi service launch in China and the robocar alliance, two sources familiar with the matter told CarNewsChina. “They (Tesla) will most likely not get the permit to transfer data collected by their fleet needed for FSD training out of China to the US. Their plan B is to co-store and locally process data with us as we already have mapping license cooperation and experience with our own robotaxi service,” the person who remains anonymous as he is not authorized to talk with the media told CNC. Tesla and Baidu, also called China’s Google, are not strangers. The two giants began their partnership in early 2020, and Tesla has already integrated Baidu’s navigation map into its vehicles in China. Last week, on April 28, it was also reported that Baidu struck a deal with Tesla to license its mapping service for data collection, paving the way to launch the FSD in China. The report concluded Elon Musk’s short trip to China, where he met with Chinese Premier Li Qiang. Musk previously announced that Tesla is now fully focused on the launch of a fully autonomous robotaxi service and will make a major announcement on May 8. The source told CNC that Tesla seeks to launch a fully autonomous robotaxi in China before the US. Baidu Apollo is Baidu’s self-driving project focusing on level 4 (L4) autonomous driving. On February 26, Baidu received the permit to offer robotaxi service at Daixing Airport in Beijing. On March 8, the company launched China’s first 24/7 fully driverless robotaxi service in Wuhan. With the approval granted by the head office of the Beijing High-Level Automated Driving Demonstration Area, Apollo Go can provide autonomous vehicles on the 40-kilometer expressway connecting Daxing International Airport and Beijing urban areas. In addition to Beijing, Baidu’s fully autonomous driving robotaxis already operates in several cities nationwide, including Chongqing, Wuhan, and Shenzhen. Baidu claims Apollo Go is the world’s largest autonomous driving mobility service provider. As of September 30, 2023, it had accumulated more than 4.1 million ride orders. In the Q3 of last year, Apollo Go provided 821,000 rides, marking a 73 percent surge compared with the previous year. Baidu is also the first company in China to get a permit for testing driverless buses on public roads. In 2022, it unveiled the Baidu RT6 Robotaxi fully autonomous concept car, which CarnewsChina had an exclusive first look at. Despite the Apollo Go progress, Baidu lacks customers for its self-driving solution. The only one so far is Jiyue Auto, which launched its Robo-01, later renamed Jiuye 01, and recently unveiled the Jiuye 07 sedan at the Beijing Auto Show. However, Jiuye is a joint venture between Baidu and Geely. Baidu Apollo faces tough competition from other Chinese autonomous driving companies like WeRide, Pony.ai, and AutoX. Moreover, EV startups are developing their own solutions, such as XNGP from Xpeng, NOP+ from Nio, NZP from Zeekr, or ADS from Huawei. Partnership with a US EV giant might be a needed cheer-up for Baidu’s AV effort. No data outside China Data security and regulatory compliance concerns have been significant hurdles for Tesla, which introduced its Autopilot software four years ago in China. However, despite strong customer demand, FSD is unavailable in the country. Since 2021, Chinese authorities have mandated that Tesla store all data gathered by its vehicles in China within the country, preventing the company from transferring any of this data back to the United States. Reports indicate that Musk wants approval to transfer the data collected from Tesla’s vehicles overseas to China. This data would be used to train algorithms for autonomous driving technologies. (CNC)

-

Renault talks to China's Li Auto and Xiaomi on tech collaboration The talks come amid an increasingly tense relationship between Europe and China. Renault has had talks with China's Li Auto and Xiaomi on electric and intelligent vehicle technologies, opening the door to potential collaboration on technology with the two companies. The talks at the Beijing auto show come amid an increasingly tense relationship between Europe and China, with the European Commission launching a series of probes into Chinese exports. Among them, it is investigating whether the rise in sales of Chinese EVs on the continent is due to unfair subsidies. China disputes the claim and has accused Europe of protectionism. "Our CEO Luca de Meo engaged in pivotal conversations with industry leaders, including our partners Geely and Dongfeng, key suppliers but also the new players like the founders of Li Auto and Xiaomi Technology," Renault's procurement and partnerships chief Francois Provost said in a post on LinkedIn. De Meo has said Europe faces a difficult balancing act to both protect its market and learn from Chinese car manufacturers, which are far ahead in development of EVs and their software. Renault already partners with China's Geely in thermal and hybrid powertrains, and collaborates with tech companies Google and Qualcomm in smart cockpits. (ANE)

-

- 186 risposte

-

- mhev

- fiat ufficiale

-

(e 8 altri in più)

Taggato come:

-

…corretto solo in parte: alla Bmw dopo G20 sara Molto probabile G50.

- 214 risposte

-

- 3

-

-

- quattroporte folgore

- quattroporte 2024

- (e 8 altri in più)

-

...dal 2026 + 10 mondiale piu avanti Newey ha 78 anni e Hamilton 51.. 😝🤣

-

Ma cosa e cosi sorpredente dal peso della Phev? Cayenne Coupe turbo ehybrid ha un peso secondo norma EU di 2570kg, la Urus Phev e la stessa macchina, era prevedibile molto bene come pesa. E questa sorta di macchine e fatta per gli amanti della dinamica longitudinale e interesato sopratutto alla sbruffoneria, per gli della guida piacevole e della dinamica trasversale ci sono altri prodotti come MX-5, Yaris GR e simile.

- 37 risposte

-

- 2

-

-

- urus se 2024

- lamborghini ufficiale

- (e 6 altri in più)

-

Ferrari - la scuderia dei vecchi uomini 😂

-

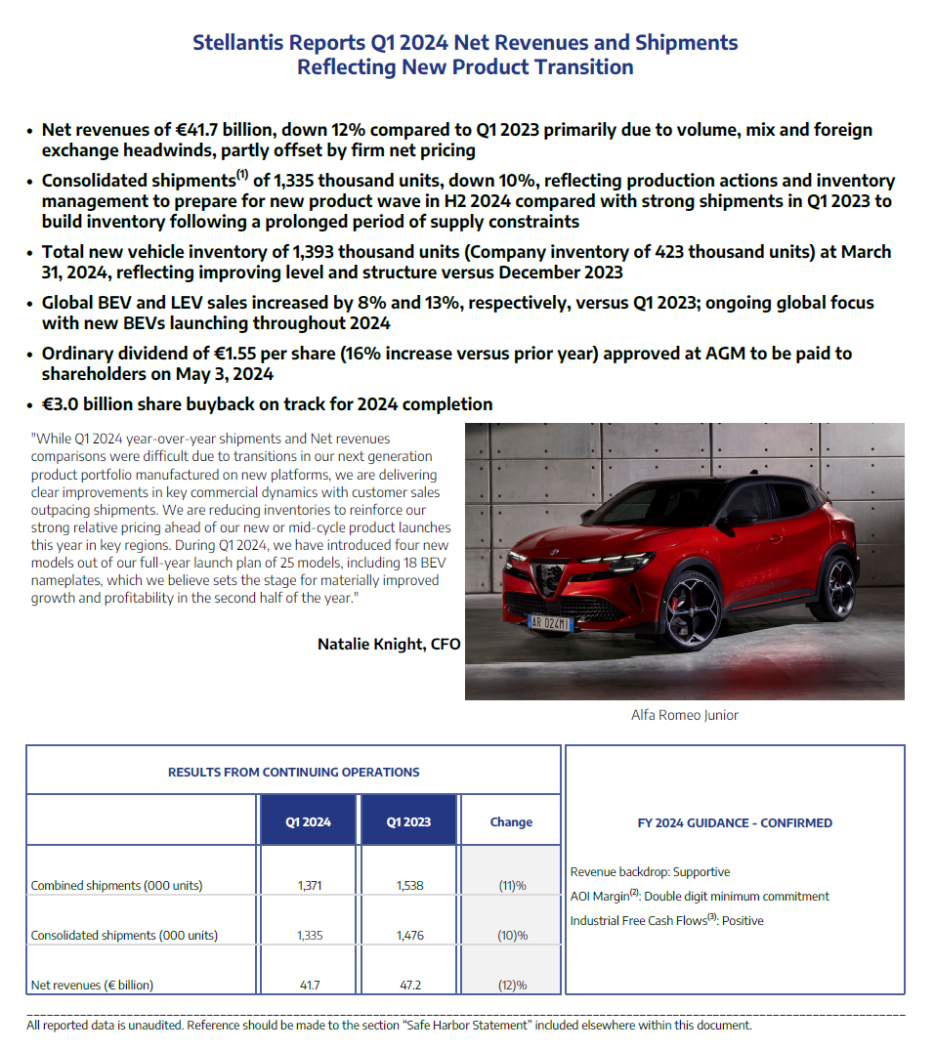

Production at three Stellantis assembly plants in Europe has been stopped for several days due to a strike at a plant run by contractor MA France. "Three sites have seen a production halt since the start of the week," a Stellantis spokesperson said on Thursday. Two of the plants are in France at Poissy and Hordain) and the third is in Luton, England. MA France, a division of Italian group CLN, specializes in stamped metal components. MA France produces components on a site in the northeastern suburbs of Paris previously used by PSA until the PSA plant was shut in 2014. PSA has since become Stellantis through its merger with Fiat Chrysler Automobiles. Workers at the plant are worried about plans to move production to Poland, said Brahim Aitathmane, head of the Force Ouvriere union at Stellantis. Stellantis is hoping that discussions underway at the factory will allow it to resume production soon, the Stellantis pokesperson said. (ANE)

-

- 37 risposte

-

- urus se 2024

- lamborghini ufficiale

- (e 6 altri in più)

-

AM&S in un articolo che si riferisce su ANE/Autocar (traduzione DeepL) per il spostamento della 4P: ....... Nuova piattaforma Ma la Maserati non è più sicura e sta pensando di utilizzare una piattaforma diversa. Ad esempio, quella della Maserati GranTurismo Folgore. L'ingegnere capo Davide Danesin spiega ad Autocar che questa soluzione potrebbe essere presa in considerazione per la Quattroporte. Cita due vantaggi. In primo luogo, la migliore agilità rispetto alla piattaforma STLA-Large e, in secondo luogo, la posizione di seduta. È più paragonabile a quella di un'auto sportiva a combustione. Il motivo di questi vantaggi è la disposizione delle batterie della GranTurismo. Le celle sono disposte a T lungo la spina dorsale del veicolo. Ciò significa che i sedili anteriori sono installati accanto alla batteria e non sopra di essa. In questo modo la posizione di seduta è più bassa rispetto a quella di un'auto elettrica convenzionale. Questa disposizione dovrebbe anche ridurre il rollio del corpo, afferma Danesin. Sottolinea inoltre che le precedenti prestazioni della Quattroporte non erano sufficienti e avevano un impatto negativo sull'autonomia. Perfezione invece di un lancio precoce sul mercato Danesin spiega: "La Quattroporte è un problema importante per Maserati. Deve essere eccezionale sotto ogni aspetto: stile, architettura, prestazioni. In futuro ci saranno anche molti miglioramenti in termini di sviluppo elettrico". Oltre all'autonomia, anche il peso ha giocato un ruolo cruciale nella decisione di posticipare il lancio della Quattroporte. "Le moderne auto elettriche stanno diventando sempre più pesanti, e dobbiamo fermare questa tendenza", sottolinea Danesin. ...... Tradotto con DeepL.com (versione gratuita)

- 214 risposte

-

- quattroporte folgore

- quattroporte 2024

- (e 8 altri in più)

-

..ma questo giallo non e "Amalfi Yellow" e non "Acid Green" della Abarth?

- 2632 risposte

-

- elettrico fiat

- fiat elettrica

- (e 15 altri in più)

-

...non credi che ci sono anche altri fattori come infrastruttura, formazione, produttivita, legislatura, burocrazia ecc. ecc.? Ridurre tutto per solo le sovvenzione mi sembra un po' troppo unilaterale.

- 7888 risposte

-

- 1

-

-

- psa

- siti produttivi

-

(e 3 altri in più)

Taggato come: